On May 1st, 2025, the Bank of Japan (BOJ) released its latest Outlook for Economic Activity and Prices. The central bank revised its real GDP growth forecast for fiscal year 2025 down to 0.5%, from 1.1% in January. It also trimmed its core CPI projection to 2.2%, signaling a slowdown in both economic activity and inflation momentum. While the BOJ maintained its policy rate, markets interpreted the tone as dovish, driving the yen lower and equity prices higher.

▶ 2025 GDP Growth Forecast Slashed to 0.5%

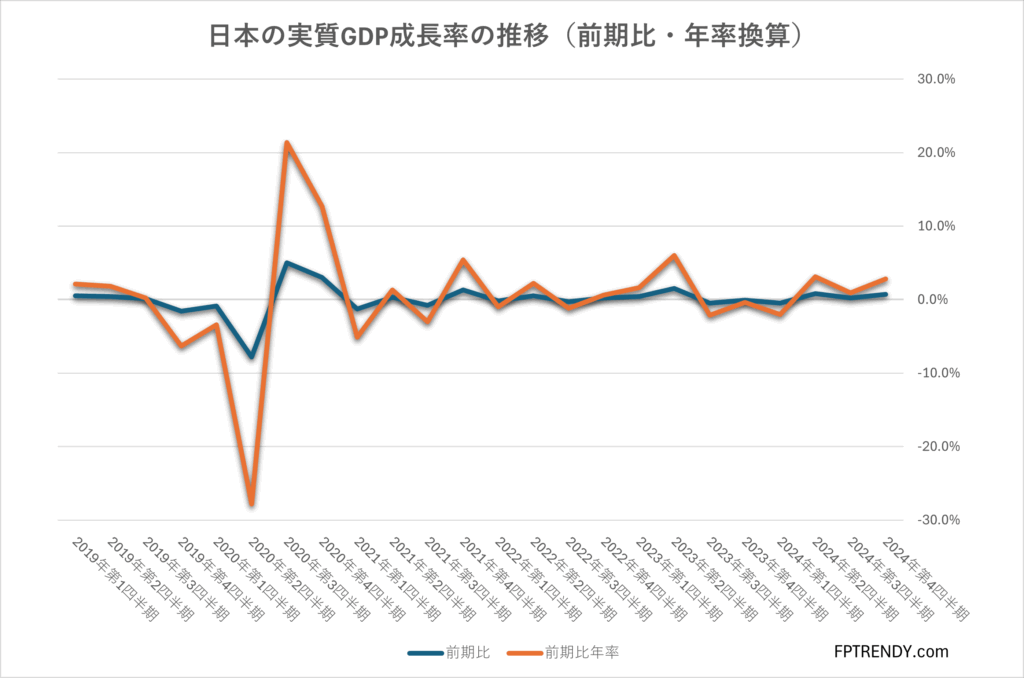

The downward revision of 0.6 percentage points reflects growing external risks, including renewed U.S. tariff measures under the Trump administration and a sluggish global economy. The BOJ now expects growth to remain subdued, projecting only 0.7% in FY2026 and 1.0% in FY2027.

As shown above, Japan’s real GDP growth trend has softened significantly since the post-pandemic rebound, with momentum stalling near zero.

▶ CPI Projections Lowered, Missing the 2% Target

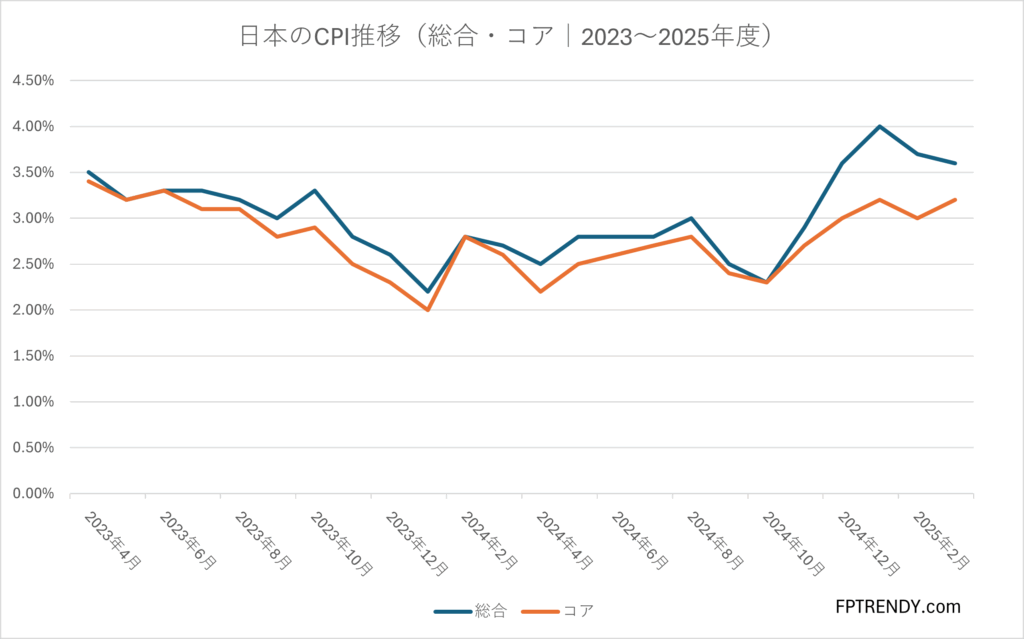

The BOJ revised its FY2025 core CPI (excluding fresh food) forecast to 2.2% from 2.4%, and FY2026 to 1.7% from 2.0%. This marks a setback in achieving the central bank’s 2% inflation target. The downgrades were attributed to lower crude oil prices and weak domestic demand.

The chart shows that both headline and core inflation have peaked in 2023 and are now on a declining trajectory.

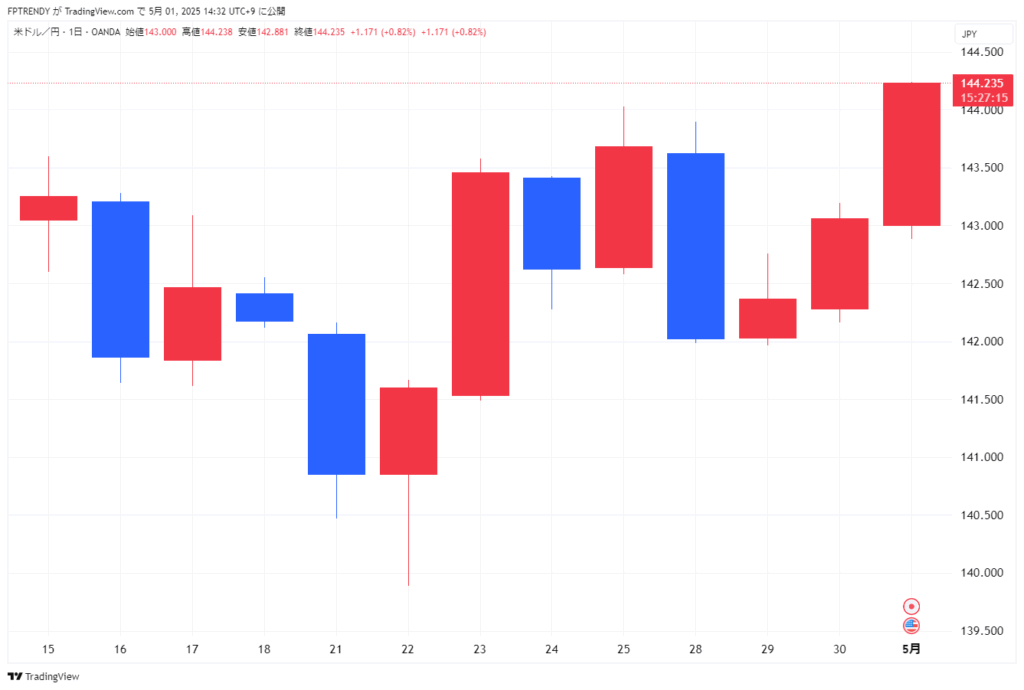

▶ Yen Weakens as Market Sees Dovish Bias

Despite keeping its forward guidance language unchanged—stating that rates may rise if inflation is deemed sustainable—investors viewed the overall tone as dovish. The yen slid to the 144 per dollar range as traders reduced expectations for further rate hikes.

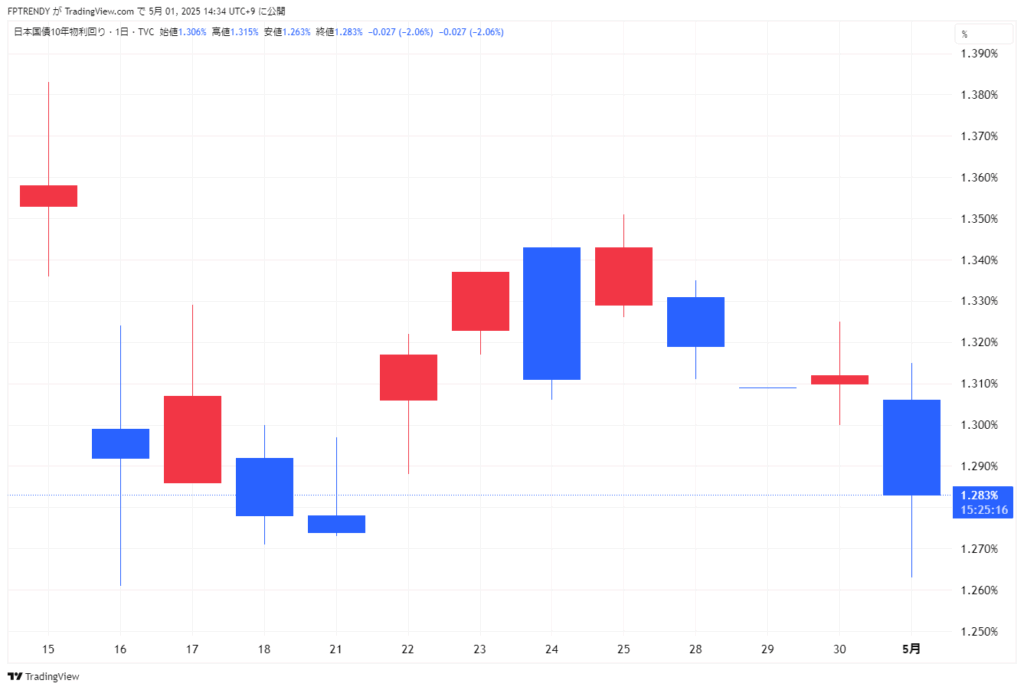

▶ Bond Yields Drop on Diminished Rate Hike Expectations

Japan’s 10-year government bond yield fell sharply to around 1.26%, the lowest level since late 2024. This reflects market consensus that the BOJ will not tighten policy further in the near term.

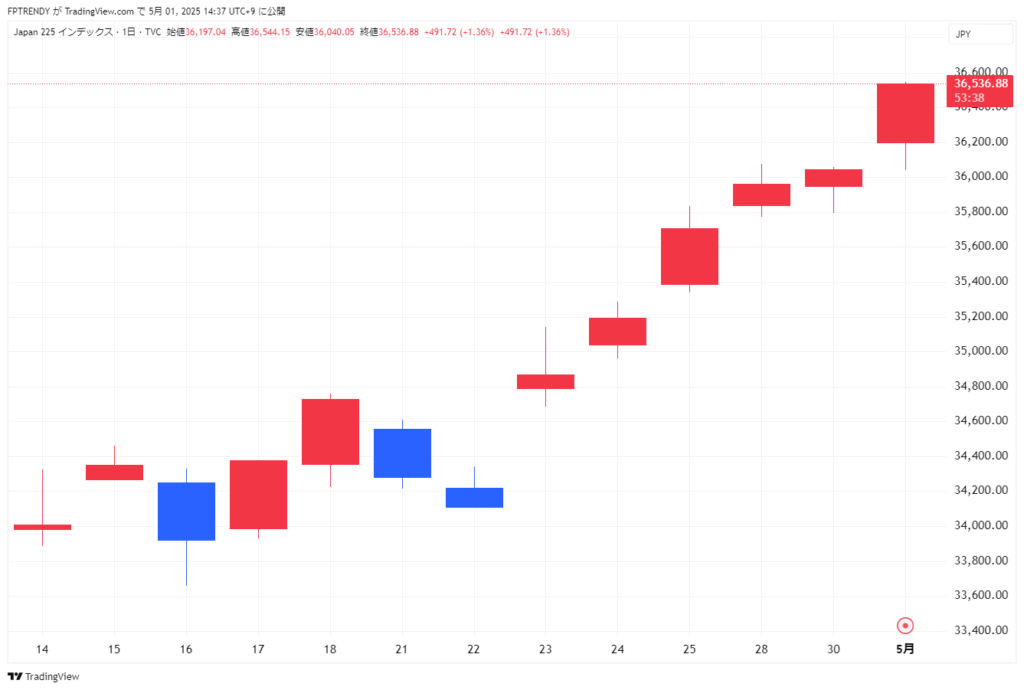

▶ Nikkei Surges Back to 36,500 as Investors Embrace Risk

With the yen weakening and policy remaining accommodative, Japanese equities rallied. The Nikkei 225 reclaimed the 36,500 level, buoyed by export-driven and tech shares.

▶ Summary: A Dovish Hold That Markets Applaud

While the BOJ technically left the door open for rate hikes, its downgraded forecasts suggest that tightening is unlikely in the near term. With inflation cooling and growth under pressure, investors are pricing in a prolonged period of accommodative policy. Whether this will stabilize the economy or delay structural adjustments remains an open question.